8 Which of the Following Will Decrease the Money Supply

D raising the money supply. A An exogenous decrease in the velocity of money.

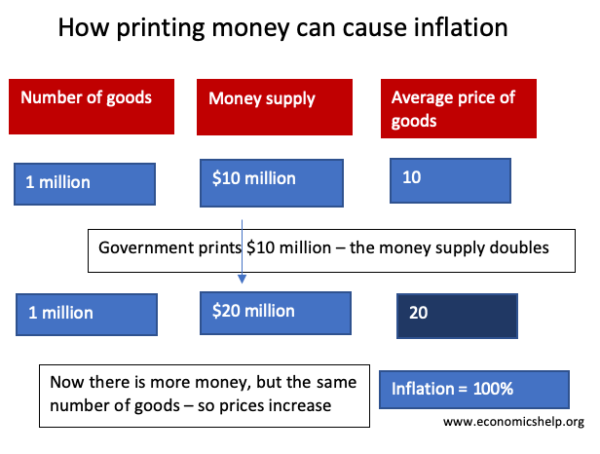

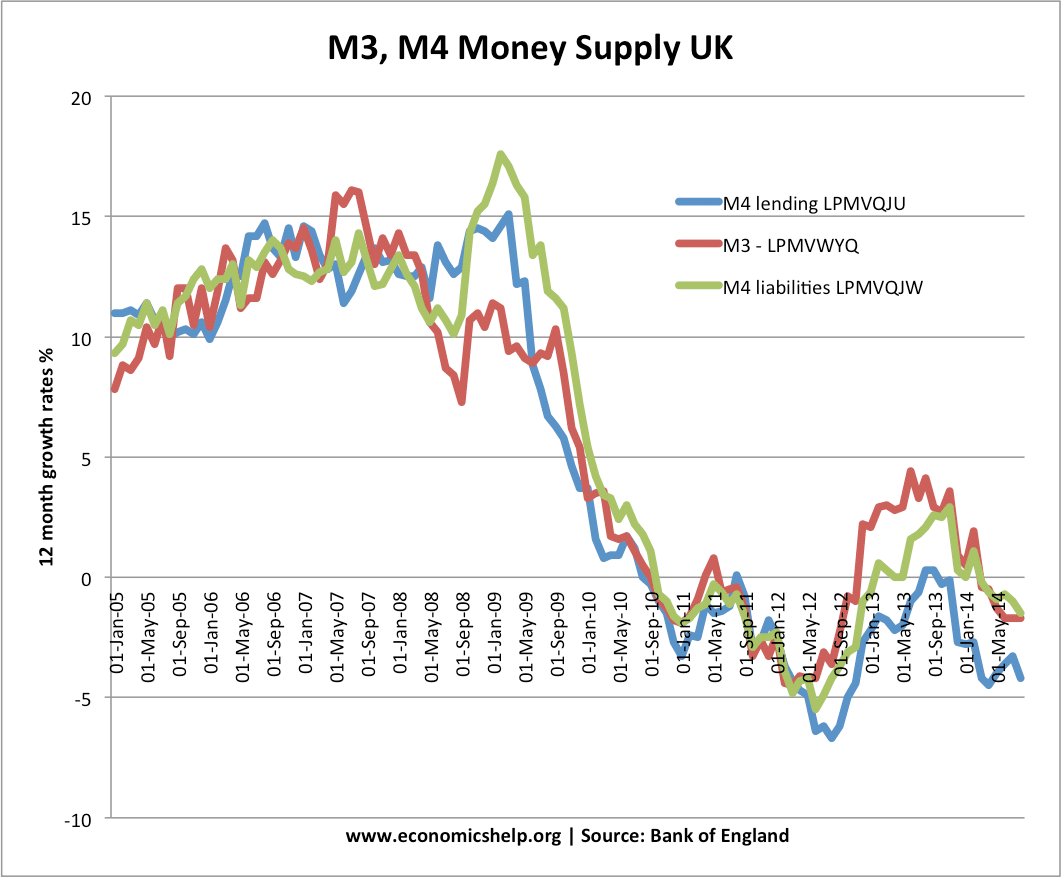

The Link Between Money Supply And Inflation Economics Help

What is the change in the money supply.

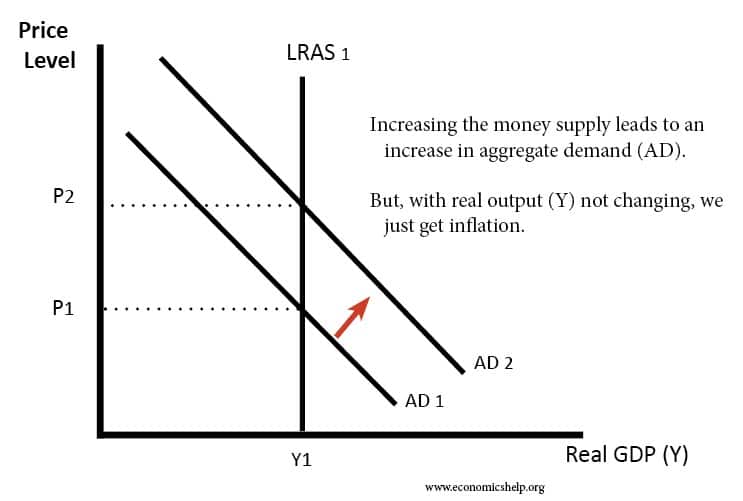

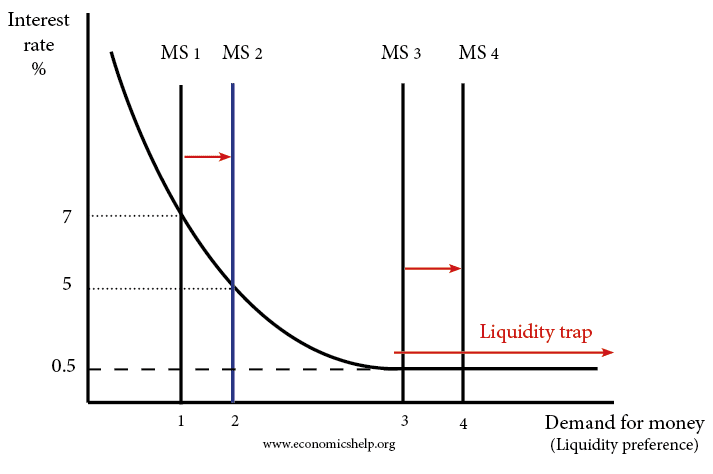

. An exogenous decrease in the velocity of money causes the aggregate demand curve to shift downward. Economics questions and answers. If supply increases shift to the right interest rate has to decrease otherwise people would not be willing to get and hold that additional money.

Raising the discount rate relative to the federal funds rate D. Which of the following lists two things that both decrease the money supply. 34-2 15If businesses and consumers become pessimistic the Federal Reserve can attempt.

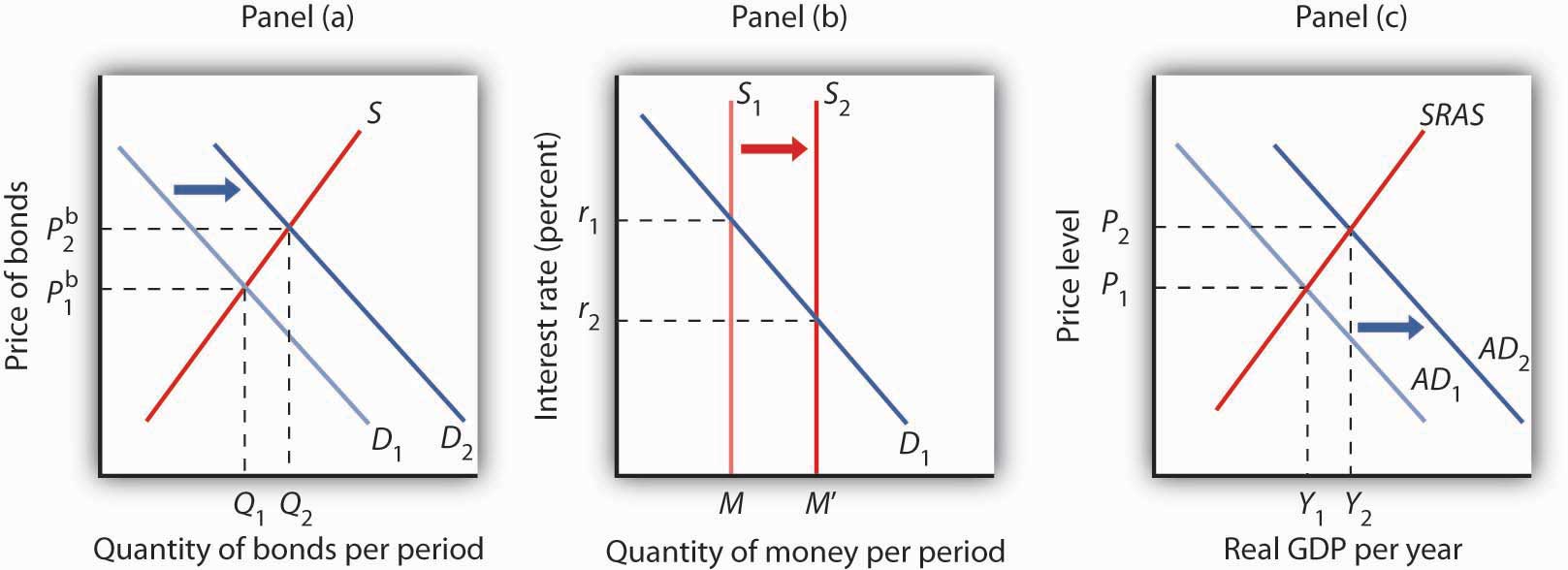

Thus the increase in the money supply will result in an increased bank. If the Fed wants to keep output and employment at their natural-rate levels it must increase aggregate demand to offset the decrease in velocity. Suppose the Fed makes an open market sale of 8 million in bonds.

An increase in the discount rate and a decrease in the interest rate on reserves c. The Fed can increase the money supply by lowering the reserve. It will sell bonds to reduce the money supply.

The money supply has increased by 16 million. All of the above. An increase in money supply can also have negative effects on the economy.

Buying bonds to decrease the money supply. With the complex global economy this can ripple out and affect other nations. B lowering the discount rate.

C Fiscal policy can be used to influence both the total output in the economy and the distribution of output between particular industries. Raise the discount rate and lower the reserve requirement ratio. Increase interest rates by increasing the money supply.

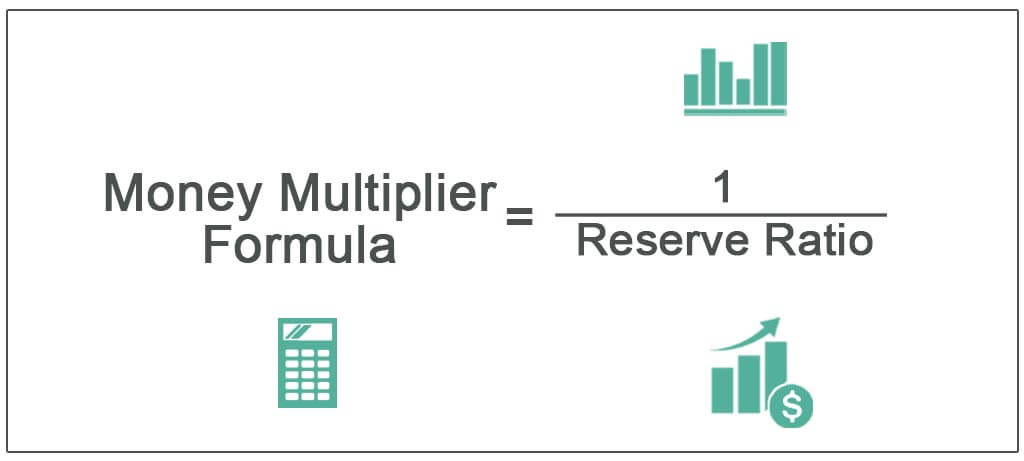

The record of the total money supply is kept by the Central Bank of the country. Assume the money multiplier is equal to 2. Steel automobiles and building materials can all cost more.

Increase shift to the right in supply. An increase in government expenditures and a decrease in the money supply C. D An increase in the budget deficit is likely to reduce aggregate demand.

Up to 25 cash back more questions Which of the following would reduce the money supply A Commercial banks use excess reserves to buy government bonds from the public B Commercial banks loan out excess reserves C Commercial banks sell government bonds to the public D A check clears from Bank A to Bank B. A decrease in government. C lowering the reserve requirement ratio.

It causes the value of the dollar to decrease making foreign goods more expensive and domestic goods cheaper. The money supply has decreased by 6 million. Reduce interest rates by decreasing the money supply.

If Bank A borrows from Bank B reserves in the banking system __________. Currency and balances held in checking accounts and savings. The Federal Reserve buys and sells government securities to control the money supply and interest rates.

Raise the discount rate and raise the reserve requirement ratio. Interest rate ensures that demand for money supply of money. A decrease in the discount rate relative to the federal funds rate.

Lower the discount rate. Which of the following raises the interest rate. An increase in government expenditures and an increase in the money supply B.

The money supply is commonly defined to be a group of safe assets that households and businesses can use to make payments or to hold as short-term investments. Reduce interest rates by increasing the money supply. Change in supply includes an increase or decrease in supply.

None of the above. The money supply in the United States is influenced by supply and demand and the actions of the Federal Reserve and commercial banks. An open market purchase of Treasury bills.

An increase in the interest rate paid on reserves d. So there are two possible changes in supply. If Congress increases taxes to balance the federal budget then to prevent additional unemployment and a recession the Fed can.

A decrease in government expenditures and an increase in the money supply D. This activity is called open market operations. A reduction in banks reserve requirements c.

The decrease in the interest would result in the cheaper loans. Which of the following will increase the money supply. The money supply is the total amount of moneycash coins and balances in bank accountsin circulation.

Selling bonds to decrease the money supply. A decrease in the discount rate and a decrease in the interest rate on reserves b. I Increase in Supply Shift to the Right.

The cheaper loans would lure the publican and it will increase the bank landing. The Fed can try to decrease the money supply by a raising the discount rate. The money supply has increased by 4 million.

An open market purchase by the Fed Correct Answer. The money supply has decreased by 4 million. Central banks use several methods called monetary policy to increase or decrease the amount of money in the economy.

Increasing the required reserve ratio B. Business Economics QA Library Which of the following actions by the Fed would reduce the money supply. To increase the money supply the Fed will purchase bonds from banks which injects money into the banking system.

Which of the following Fed actions will decrease the money supply. You have supply of money by central bank and then you have demand for money by people. Decrease shift to the left in supply.

Correct option is D Fall in repo rate means bank get loans for less interest from RBI then banks give loans to there customersas this will increase buying capacity of people since banks will give loan to all liberal people. Therefore banks and other financial institution would be able to provide loans at the rate of interest. The money supply is the total amount of money currencydeposit money present in an economy at a particular point in time.

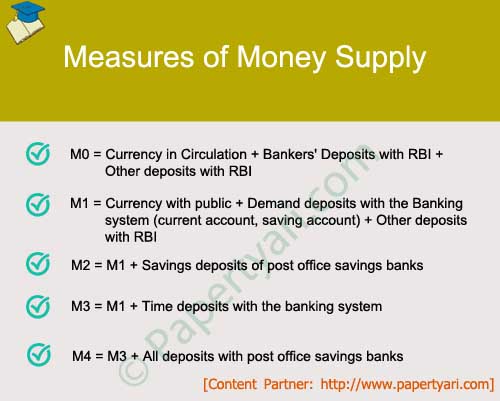

The standard measures to define money usually include currency in circulation and demand deposits. A decrease in the discount. It may be due to the change in the price of related goods income taste and preference of consumers etc.

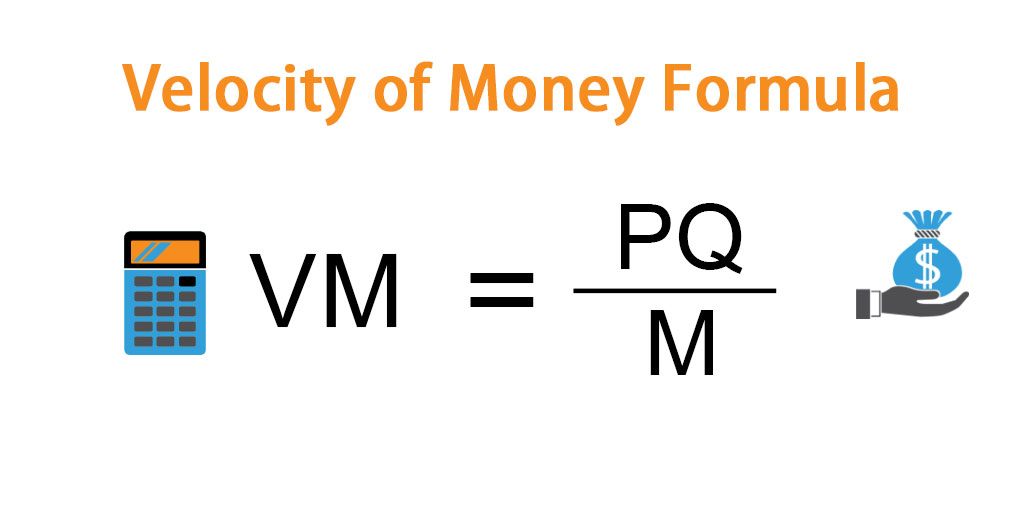

Which of the following both decrease the money supply. The rate would decrease. An economy had nominal GDP growth of 8 last year inflation of 55 and population growth of 25.

A decrease in the discount rate on Fed lending. An open market sale by the Fed C. Selling bonds to increase the money supply.

Buying bonds to increase the money supply b. An open-market purchase of govenrment bonds b. An increase in the required reserve ratio.

In the short run prices are fixed so output falls.

25 2 Demand Supply And Equilibrium In The Money Market Principles Of Economics

Velocity Of Money Formula Calculator Examples With Excel Template

Contractionary Monetary Policy Definition Tools And Effects

Money Supply M0 M1 And M2 Video Khan Academy

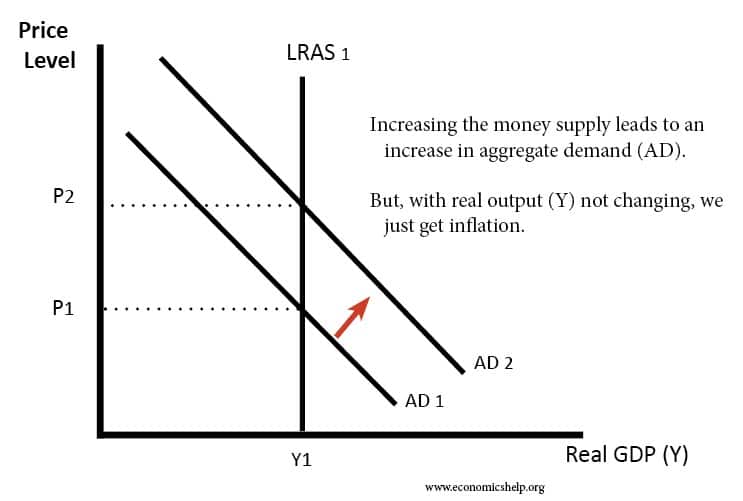

Increasing Money Supply Economics Help

Quantity Theory Of Money Video Khan Academy

The Money Supply Measuring M1 M2 Datapost Teacher Resources Money Make More Money

Measuring Money Currency M1 And M2 Principles Of Economics 2e

The Link Between Money Supply And Inflation Economics Help

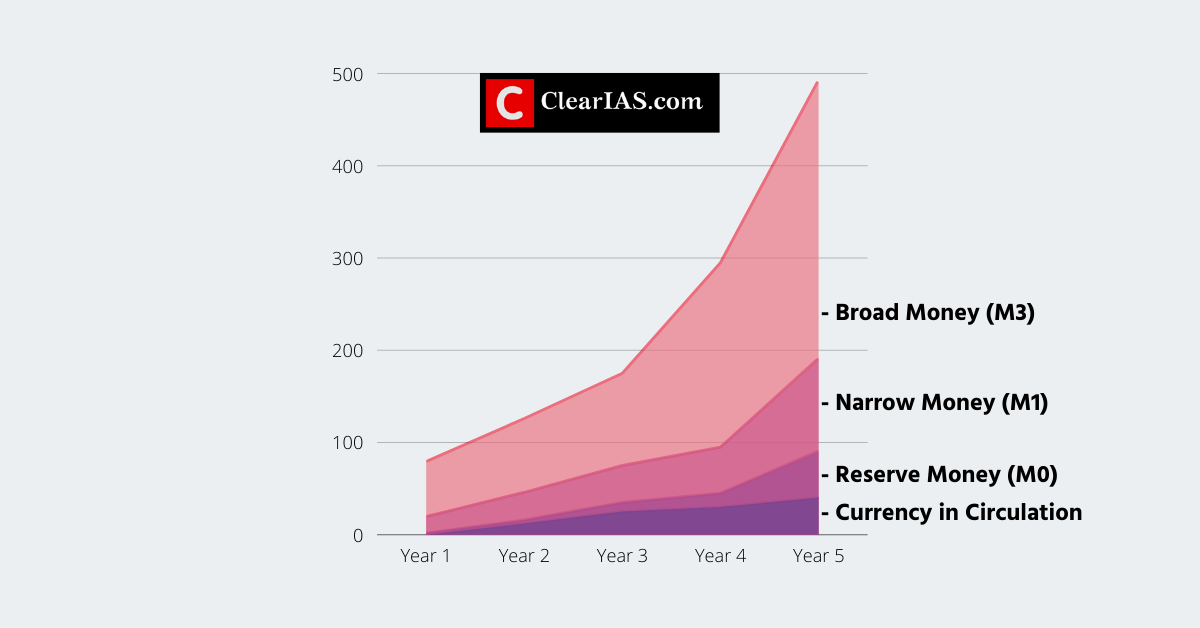

Measures Of Money Supply M0 M1 M2 M3 And M4 Paper Tyari

Monetary And Fiscal Policy Effects On Small Businesses Economics Lessons Economics Notes Life Hacks For School

What Is Money Supply Definition And Concept Explained Clearias

Money Multiplier Formula Step By Step Calculation Examples

/dotdash_final_Deposit_Multiplier_Dec_2020-01-12355ee057a74ef1887bb1066444b606.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Reserve_Ratio_Definition_Oct_2020-01-abeb9a9e7e894fddbbbf82dc746152f5.jpg)

Comments

Post a Comment